Limit Orders Vs. Market Orders: Pros And Cons

Limit orders vs. Square commands: understanding differences in cryptocurrency trading

The world of cryptocurrency trading has increased exponentially over the years, with numerous trading platforms and tools available for investors to participate. Two popular types of orders that traders use to buy or sell cryptocurrencies are limited orders and market orders. While both orders are essential tools for cryptocurrency browsing market, they differ significantly in their characteristics and implications.

What is a market order?

A market order, also known as the “market” order name, is an all-or type of order to specify the price at which to buy or sell a currency. When placed with a market order, it will be executed immediately at that specified price without conditions. For example, if a trader wants to buy 100 Bitcoin units (BTC) at $ 10,000, it can place a market order to buy as many units at the current market price.

PRO and Cons against market commands:

Pro:

- Instant execution : Market orders are executed immediately at the specified price, allowing traders to quickly take advantage of the favorable market conditions.

- Flexibility : Market commands are simple to place, which makes it easy for beginners to enter the market.

- Low risk : Because the orders on the market are executed at a fixed price, there is no risk of staying with unsold or over -stated positions.

Against:

- Limited control : With a market command, traders have limited control over their transactions, because they are subjected to market fluctuations and may not be able to adjust the price.

- Fără rată de umplere : Comenzile de piață de obicei nu au o rată de umplere, ceea ce înseamnă că, chiar dacă prețul de piață se deplasează în favoarea poziției comerciantului, ar putea totuși să nu poată cumpăra sau să vândă due to liquidity problems.

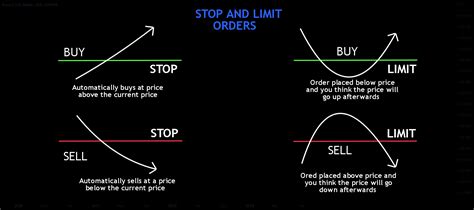

What is a limit order?

A limit order, also known as “limit”, specifies a specific price to buy or sell a currency. Unlike market orders, the limit orders are not all or nothing and can be partially completed if the market price reaches the desired level before being executed.

There are two types of limit commands:

- ORDER OF STOP LOSS : A stop loss command is used to limit potential losses by automatic selling at an established price (stop loss) when trade drops below this price.

- Take the profit command : A taking profit order is used to block profits by automatic selling at a set price (take profit) when the trade reaches this level.

PRO and Cons against limit orders:

Pro:

- Control and flexibility : The limit orders allow traders to set specific prices, allowing them to control their transactions and to adapt more easily to the market conditions.

- Filling rate : The limit controls have a higher filling rate compared to the market orders, because they are executed at the specified price, reducing the risk of unsold or overvalued positions.

- Risk Management : Limit orders can help traders manage their risk, allowing them to establish stop losses and take profits.

Against:

- Delayed execution : because the limit orders are not executed immediately, traders can experience a delayed execution, which can lead to missed opportunities.

- increased risk : Limit orders require traders to have a solid understanding of market conditions and be able to adjust their prices accordingly, increasing the risk of losses if market conditions change suddenly.

Conclusion

The trading of cryptocurrencies requires a deep understanding of both market and limit orders. While market commands provide instant execution and flexibility, they also come with limited control over transactions and without filling rate. Limit orders offer traders more control and flexibility, but require greater knowledge about market conditions and risk management strategies.